Lipa Mdogo Mdogo: Own it Now, Pay Later!

Overview

Lipa Mdogo Mdogo: Own it Now, Pay Later!

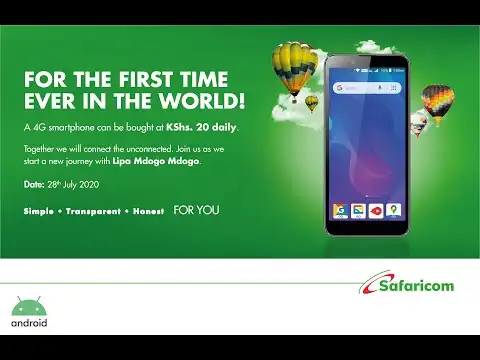

In today's fast-paced world, access to essential electronics like smartphones and TVs is more important than ever. But what happens when your budget doesn't quite stretch to cover the upfront cost? That's where "Lipa Mdogo Mdogo" comes in – a game-changing payment solution that's transforming how Kenyans acquire the technology they need.

Lipa Mdogo Mdogo, which translates to "pay little by little" in Swahili, offers an affordable installment plan, allowing you to own your desired electronic gadgets and pay for them in smaller, manageable installments. Forget about hefty upfront payments or long-term loans with crippling interest rates. Lipa Mdogo Mdogo offers flexible payment options, putting the power in your hands to control your finances while enjoying the benefits of modern technology.

Imagine finally owning that high-definition TV you've always dreamed of, perfect for family movie nights and enjoying your favorite sports. Or picture upgrading to a smartphone with a better camera and faster processor, enabling you to stay connected and productive on the go. With Lipa Mdogo Mdogo, these aspirations become a reality, without straining your budget.

This innovative approach is especially beneficial for Kenyans who may not have access to traditional banking services or credit facilities. It provides a pathway to ownership, empowering individuals and families to improve their quality of life through access to information, entertainment, and communication. So, whether you're looking for lipa mdogo mdogo phones in Kenya or lipa mdogo mdogo TVs, explore the possibilities and discover how you can own it now and pay later!

Why Lipa Mdogo Mdogo is Gaining Popularity in Kenya

The Lipa Mdogo Mdogo model is proving to be a resounding success in Kenya due to its accessibility and affordability. It addresses a critical need for flexible payment options that cater to the unique financial circumstances of many Kenyans. By breaking down the total cost into smaller, more manageable installments, it democratizes access to essential electronics and empowers individuals to improve their lives.

More Kenyans can now afford smartphones and TVs and other home appliances. It promotes digital inclusion, enabling more people to participate in the digital economy and access information, education, and entertainment.

Specifications

GENERAL

| Product Type | Smartphone/TV/Home Appliance |

|---|---|

| Payment Plan | Installment based |

| Availability | Kenya |

| Target Audience | Adults |

| Brand Options | Varies by retailer |

SMARTPHONE FEATURES

| Operating System | Android (typical) |

|---|---|

| Screen Size | Varies by model |

| Camera Resolution | Varies by model |

| Storage Capacity | Varies by model |

| Network Support | 4G LTE or better |

TV FEATURES

| Screen Size | Varies by model |

|---|---|

| Display Type | LED/Smart TV |

| Resolution | HD/Full HD/4K |

| Smart Features | Yes (typical) |

| Connectivity | HDMI, USB, Wi-Fi |

PAYMENT DETAILS

| Deposit Amount | Varies by retailer |

|---|---|

| Installment Frequency | Daily/Weekly/Monthly |

| Payment Methods | M-Pesa common |

| Contract Length | Varies by product |

| Interest Rate | Often built into price |

ELIGIBILITY REQUIREMENTS

| Identification | National ID |

|---|---|

| Mobile Number | Registered M-Pesa |

| Credit Check | Often not required |

| Age Requirement | 18 years and above |

| Location | Within Kenya |

WARRANTY & SUPPORT

| Warranty Period | Varies by retailer |

|---|---|

| Support Channels | Phone/In-person |

| Repair Options | Authorized service centers |

| Replacement Policy | Varies by provider |

| Service Availability | Throughout Kenya |

ADDITIONAL BENEFITS

| Insurance Options | Often included |

|---|---|

| Upgrade Programs | Some providers offer |

| Loyalty Rewards | Available with select deals |

| Data Bundles | Sometimes included |

| Customer Education | Provided by retailers |

APPLICATION PROCESS

| Application Location | Retail store/Online |

|---|---|

| Documentation | ID, mobile number |

| Approval Time | Quick, often instant |

| Activation Fee | May be applicable |

| Contract Signing | Required for agreement |

DEVICE LOCKING

| Device Locking | Common during payments |

|---|---|

| Unlocking Process | Upon full payment |

| Security Measures | To prevent theft |

| Remote Locking | Provider can disable |

| Notification System | Payment reminders |

REPUTABLE PROVIDERS

| Brand 1 | Mkopa |

|---|---|

| Brand 2 | Asante |

| Brand 3 | Easy Buy |

| Brand 4 | Varies Regionally |

| Research | Compare offerings |

Compare related product

|

|

Lipa Mdogo Mdogo Phone A | Lipa Mdogo Mdogo Phone B | Lipa Mdogo Mdogo TV A | Lipa Mdogo Mdogo TV B |

|---|---|---|---|---|

| Screen Size | 6.5 inch | 6.2 inch | 43 inch | 50 inch |

| Display Type | LCD | OLED | LED | QLED |

| Resolution | 720 x 1600 | 1080 x 2400 | 1920 x 1080 | 3840 x 2160 |

| Operating System (Phones) | Android 11 | Android 12 | N/A | N/A |

| Smart TV Features | N/A | N/A | Yes | Yes |

| Processor (Phones) | Quad-core | Octa-core | N/A | N/A |

| RAM (Phones) | 2 GB | 4 GB | N/A | N/A |

| Internal Storage (Phones) | 32 GB | 64 GB | N/A | N/A |

| Camera (Phones) | 13MP + 2MP | 48MP + 8MP + 2MP | N/A | N/A |

| Front Camera (Phones) | 5MP | 16MP | N/A | N/A |

| Connectivity (TVs) | N/A | N/A | HDMI, USB, Wi-Fi | HDMI, USB, Wi-Fi |

| Smart Features (TVs) | N/A | N/A | Netflix, YouTube | Netflix, YouTube, Browser |

| Payment Frequency | Daily | Weekly | Daily | Weekly |

| Deposit Amount | KES 1,000 | KES 2,000 | KES 1,500 | KES 3,000 |

| Daily/Weekly Installment | KES 50 | KES 350 | KES 75 | KES 500 |

| Total Cost (Estimated) | KES 18,000 | KES 25,000 | KES 27,000 | KES 36,000 |

| Warranty | 6 months | 1 year | 1 year | 1 year |

| Provider | Mkopa | Asante | Easy Buy | Mkopa |

| Insurance | Included | Optional | Included | Included |

| Device Locking | Yes | Yes | Yes | Yes |

| Unlocking | Upon full payment | Upon full payment | Upon full payment | Upon full payment |

| Upgrade Program | No | Yes | No | Yes |

| Customer Support | Phone, In-person | Phone, Online | Phone, In-person | Phone, Online |

| Additional Features | Basic functionality | Better camera, more storage | Larger screen, basic smart features | High-resolution, advanced smart features |

Benefit

Why Choose Lipa Mdogo Mdogo in Kenya?

Lipa Mdogo Mdogo isn't just a payment plan; it's an opportunity. It's a chance to bridge the gap between your aspirations and your current financial situation. Here's why embracing Lipa Mdogo Mdogo could be the smartest decision you make for yourself and your family:

- Affordability: The most significant advantage is, of course, affordability. By breaking down the total cost into small, manageable installments, Lipa Mdogo Mdogo makes owning essential electronics accessible to a wider range of Kenyans. No more saving for months or years, or taking out high-interest loans.

- Convenience: The flexible payment options cater to your unique financial circumstances. Whether you prefer to pay daily, weekly, or monthly, you can choose a plan that aligns with your income flow. Payment methods are also designed for ease of use, with M-Pesa being a common and convenient option.

- Empowerment: Lipa Mdogo Mdogo empowers you to take control of your finances and make informed purchasing decisions. You know exactly what you're paying for, and you can track your progress towards ownership. This transparency fosters financial literacy and promotes responsible spending habits.

- Improved Quality of Life: Access to smartphones and TVs can significantly improve your quality of life. Smartphones enable you to stay connected with loved ones, access information and education, and participate in the digital economy. TVs provide entertainment, education, and a shared experience for the whole family.

- No Credit Checks: Many Lipa Mdogo Mdogo providers don't require extensive credit checks, making it easier for individuals with limited credit history to qualify. This is particularly beneficial for Kenyans who may not have access to traditional banking services.

- Insurance and Warranty: Many Lipa Mdogo Mdogo plans include insurance and warranty coverage, protecting your investment against theft, damage, or defects. This provides peace of mind and ensures that you can enjoy your electronics without worry.

In conclusion, Lipa Mdogo Mdogo is more than just a payment solution; it's a catalyst for positive change. It empowers individuals, improves lives, and promotes financial inclusion in Kenya. So, if you're looking for a way to own the electronics you need without breaking the bank, explore the possibilities of Lipa Mdogo Mdogo and discover how you can own it now, pay later!

Description

Lipa Mdogo Mdogo: A Comprehensive Guide to Owning Electronics in Kenya Through Installments

In Kenya, the "Lipa Mdogo Mdogo" model has emerged as a revolutionary approach to acquiring essential electronics and appliances. This system, which translates to "pay little by little" in Swahili, enables individuals to purchase items such as smartphones, televisions, and even household appliances through manageable installment plans. This comprehensive guide explores the intricacies of Lipa Mdogo Mdogo, its benefits, how it works, best practices, and expert tips to navigate this payment solution effectively.

Understanding Lipa Mdogo Mdogo

Lipa Mdogo Mdogo is a payment plan that allows customers to pay for goods in small, incremental installments over a defined period. This model is particularly popular for high-value items that might otherwise be unaffordable for many Kenyans. The essence of Lipa Mdogo Mdogo lies in its accessibility and flexibility, making it an attractive option for those with limited access to traditional credit facilities.

Key Features of Lipa Mdogo Mdogo

- Affordable Installments: The core feature is the ability to spread the cost of an item into small, regular payments, such as daily, weekly, or monthly installments.

- No Credit Checks: Many providers do not require stringent credit checks, making it accessible to a broader audience, including those with little to no credit history.

- Device Locking: To secure their investment, providers often use device-locking technology, which restricts the functionality of the device until full payment is made.

- Inclusive Packages: Some plans include additional benefits such as insurance against theft or damage, and even data bundles for smartphones.

Benefits of Lipa Mdogo Mdogo

The Lipa Mdogo Mdogo model offers numerous advantages for both consumers and providers, contributing to its widespread adoption in Kenya.

For Consumers

- Increased Accessibility: Enables individuals to acquire essential electronics and appliances that would otherwise be financially out of reach.

- Budget-Friendly: The small, regular payments make budgeting easier and prevent financial strain.

- Convenient Payment Options: Payments can typically be made via M-Pesa, a widely used mobile money service in Kenya, offering convenience and ease of use.

- Financial Empowerment: Provides a pathway to ownership, fostering a sense of financial responsibility and accomplishment.

For Providers

- Expanded Market Reach: Opens up opportunities to serve a broader customer base, including those who are unbanked or have limited access to credit.

- Reduced Risk: Device-locking technology and insurance options mitigate the risk of non-payment or loss due to theft or damage.

- Customer Loyalty: By offering flexible payment plans, providers can build strong relationships with customers and foster long-term loyalty.

How Lipa Mdogo Mdogo Works

The process of acquiring goods through Lipa Mdogo Mdogo typically involves several steps:

- Selection of Item: The customer selects the desired product, such as a smartphone or TV, from a participating retailer or provider.

- Agreement and Deposit: The customer enters into an agreement with the provider, outlining the terms of the payment plan, including the deposit amount, installment frequency, and total cost.

- Payment Schedule: The customer makes regular payments according to the agreed-upon schedule, typically via M-Pesa.

- Device Locking: The device is often locked with software that restricts its functionality until all payments are completed.

- Full Ownership: Once all payments are made, the device is unlocked, and the customer gains full ownership.

Best Practices for Lipa Mdogo Mdogo

To make the most of Lipa Mdogo Mdogo and avoid potential pitfalls, consider these best practices:

- Research and Compare: Compare different providers and plans to find the best fit for your needs and budget. Consider factors such as deposit amount, installment frequency, total cost, insurance options, and warranty coverage.

- Read the Fine Print: Carefully review the terms and conditions of the agreement before signing up. Pay attention to details such as interest rates, late payment fees, and device-locking policies.

- Budget Wisely: Ensure that you can comfortably afford the regular installments without straining your finances. Create a budget that accounts for all your expenses and income, and allocate funds specifically for Lipa Mdogo Mdogo payments.

- Make Payments on Time: Avoid late payments, as they can result in penalties, such as late fees or temporary device locking. Set reminders to ensure that you make payments on time, or consider setting up automated payments through M-Pesa.

- Protect Your Device: Take good care of your device to prevent damage or theft. Consider purchasing additional insurance if it is not included in the Lipa Mdogo Mdogo plan.

- Communicate with Your Provider: If you encounter any difficulties making payments or have questions about the Lipa Mdogo Mdogo plan, contact your provider for assistance. Open communication can help resolve issues and prevent misunderstandings.

Expert Tips for Navigating Lipa Mdogo Mdogo

Here are some expert tips to help you navigate Lipa Mdogo Mdogo effectively:

- Negotiate Terms: Don't be afraid to negotiate the terms of the Lipa Mdogo Mdogo plan with the provider. You may be able to negotiate a lower deposit amount, a longer payment period, or more favorable interest rates.

- Consider Refurbished Options: If you're on a tight budget, consider purchasing a refurbished device through Lipa Mdogo Mdogo. Refurbished devices are typically more affordable than new devices, and they often come with a warranty.

- Take Advantage of Promotions: Keep an eye out for promotions and discounts offered by Lipa Mdogo Mdogo providers. You may be able to save money on the deposit amount, installments, or total cost.

- Use Device Locking to Your Advantage: While device locking can be inconvenient, it can also be a powerful tool for self-discipline. Use it as a reminder to make payments on time and stay on track with your financial goals.

- Explore Upgrade Options: Some Lipa Mdogo Mdogo providers offer upgrade options, allowing you to trade in your old device for a newer model after a certain period. This can be a great way to stay up-to-date with the latest technology without breaking the bank.

- Read Online Reviews: Before choosing a Lipa Mdogo Mdogo provider, read online reviews from other customers. This can provide valuable insights into the provider's reputation, customer service, and overall reliability.

The Future of Lipa Mdogo Mdogo in Kenya

The Lipa Mdogo Mdogo model is poised to play an increasingly important role in Kenya's economy. As more providers enter the market and technology continues to evolve, Lipa Mdogo Mdogo is expected to become even more accessible, affordable, and convenient. This payment solution has the potential to empower millions of Kenyans, bridge the digital divide, and drive economic growth.

Conclusion

Lipa Mdogo Mdogo is a transformative payment solution that is revolutionizing how Kenyans acquire essential electronics and appliances. By offering affordable installments, convenient payment options, and innovative features such as device locking, Lipa Mdogo Mdogo is making ownership accessible to a wider range of individuals and families. By following the best practices and expert tips outlined in this guide, you can navigate Lipa Mdogo Mdogo effectively and unlock the benefits of this innovative payment solution.

Question & Answer

Q: What is Lipa Mdogo Mdogo?

A: Lipa Mdogo Mdogo is a payment plan in Kenya that allows you to purchase items, like phones and TVs, by paying in small, manageable installments over a set period, making it easier to afford expensive items.

Q: How does Lipa Mdogo Mdogo work?

A: You select an item, agree to a payment plan with a deposit and regular installments (daily, weekly, etc.), make payments, and once fully paid, the item is unlocked for your full use.

Q: What items can I buy with Lipa Mdogo Mdogo?

A: Typically, you can buy smartphones, televisions, and sometimes other household appliances, depending on the provider offering the Lipa Mdogo Mdogo plan.

Q: Do I need a bank account to use Lipa Mdogo Mdogo?

A: No, many Lipa Mdogo Mdogo services allow payments through M-Pesa, a mobile money service, making it accessible even without a traditional bank account.

Q: Is there interest charged on Lipa Mdogo Mdogo plans?

A: Yes, often there is an implicit or explicit interest component. The total you pay will likely be more than the upfront cash price due to this financing cost, so compare carefully.

Q: What happens if I miss a payment?

A: Missing a payment can lead to penalties, such as late fees or temporary locking of the device. Consistent missed payments may result in repossession of the item, so stay on track.

Q: What is device locking and why is it used?

A: Device locking is a security feature where the device's functionality is limited until full payment is made. It protects the provider's investment and encourages timely payments.

Q: Can I unlock the device before completing all payments?

A: Generally, no. The device remains locked until all payments are successfully completed according to the agreed-upon payment plan terms with the provider.

Q: Are there any additional fees besides the installments?

A: Yes, be aware of potential additional fees such as late payment fees, activation fees, or insurance costs. Review the terms carefully to understand all potential expenses.

Q: Is insurance included in Lipa Mdogo Mdogo plans?

A: Some providers include insurance against theft or damage as part of the plan, while others offer it as an optional add-on, ensuring your device is protected.

Q: How do I apply for Lipa Mdogo Mdogo?

A: You typically apply at a retail store or through an online platform by providing your identification and mobile number. Approval is often quick, with minimal paperwork.

Q: Can I return the item if I don't want it anymore?

A: Return policies vary by provider, but generally, you are obligated to continue payments as per the agreement. Returning the item might not cancel the payment obligation.

Q: How does Lipa Mdogo Mdogo affect my credit score?

A: While many don't require credit checks initially, consistent late payments could be reported to credit bureaus, negatively impacting your credit score in the long run.

Q: What documents do I need to apply?

A: Typically, you need a valid National ID and a registered mobile number (usually M-Pesa) to apply for a Lipa Mdogo Mdogo plan.

Q: Can I upgrade my device during the payment period?

A: Some providers offer upgrade programs where you can trade in your current device for a newer model after a certain period, continuing with a new Lipa Mdogo Mdogo plan.

Q: What happens if the device is stolen or damaged?

A: If you have insurance included in your plan, you can file a claim to cover the loss or damage. Without insurance, you may still be responsible for the remaining payments.

Q: How do I make payments for Lipa Mdogo Mdogo?

A: Payments are commonly made through M-Pesa, where you send the installment amount to the provider's paybill number, making it easy and convenient to manage your payments.

Q: Are there any reputable Lipa Mdogo Mdogo providers in Kenya?

A: Yes, some well-known providers include Mkopa, Asante, and Easy Buy. It’s always a good idea to research and compare their offerings to find the best fit.

Q: Can I pay off the remaining balance early?

A: Some providers allow you to pay off the remaining balance early, but you may still be required to pay the total amount as initially agreed, including the interest component.

Q: Is Lipa Mdogo Mdogo available throughout Kenya?

A: Yes, Lipa Mdogo Mdogo services are generally available throughout Kenya, although the specific providers and their coverage areas might vary by region.